Summary/Print Page

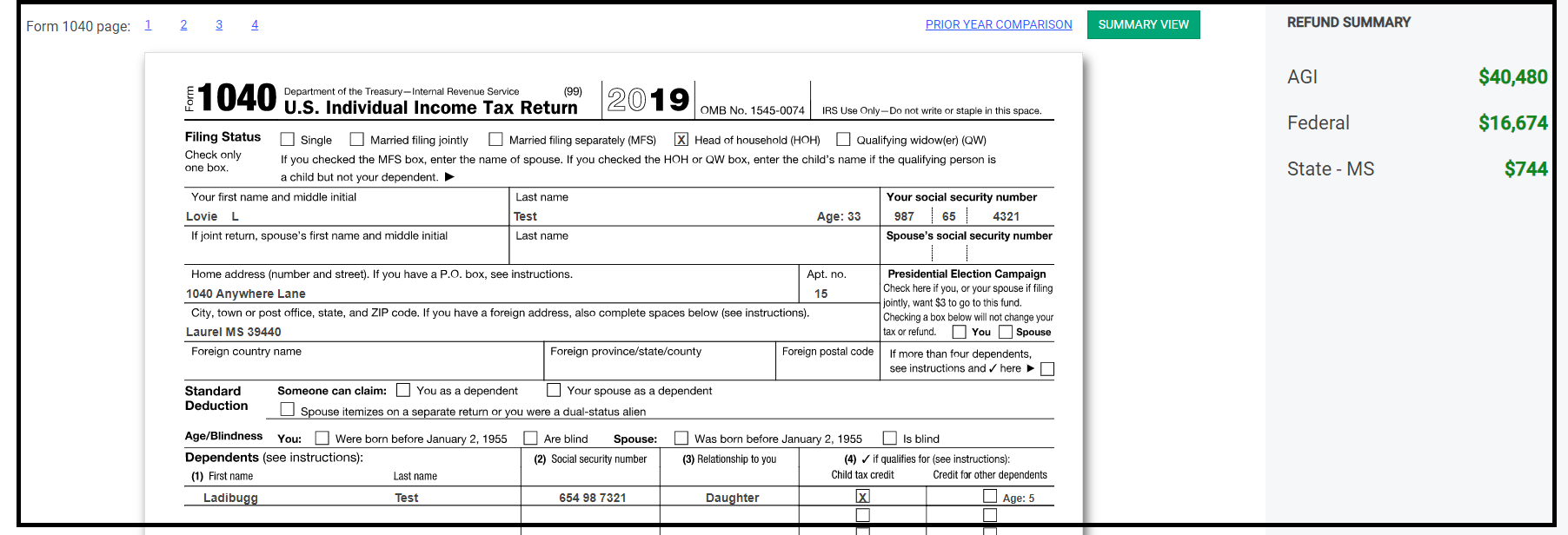

The Calculation Summary page is an overview of the tax return. It will show an interactive 1040 View for you to quickly review and select the areas you need to check/adjust. You can also choose to use the Summary View, which is a line-by-line breakdown of what items are included in the tax return. You can view and/or edit each item of income, adjustments, tax, payments etc. by selecting the link from the expanded list.

To switch between the 1040 View and the Summary View, click the green button under Continue.

Validation

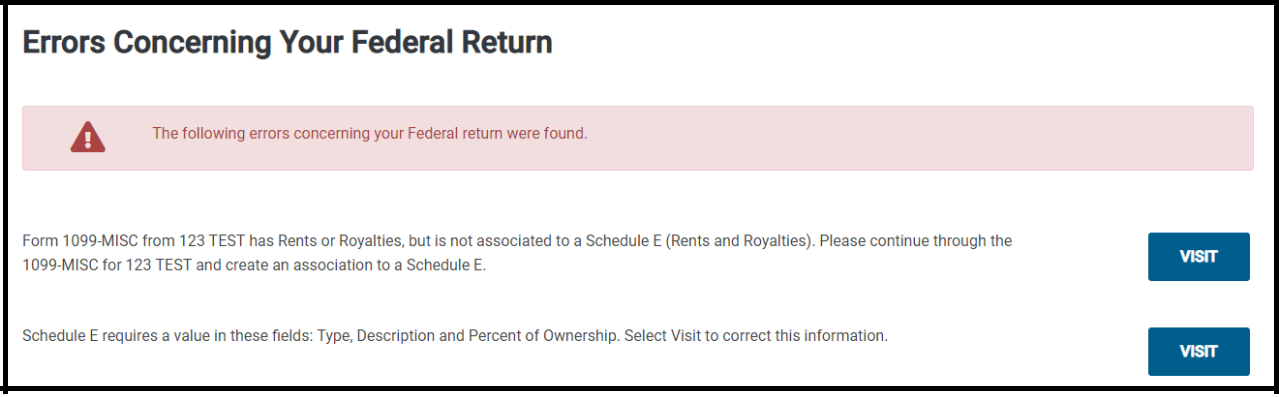

After the tax return has been reviewed and any necessary changes have been made from the summary screen, the return is ready to be electronically filed. Select Continue. At this point, a series of diagnostics will be run on the return checking for validation errors. If errors are found, a description of each error will be displayed on the screen.

To correct a validation error, select Make Corrections. This will take you back to the Federal or State return. Based on the validation error present in the return, select the specific part of the return needing corrections. After making any necessary corrections, click Continue.

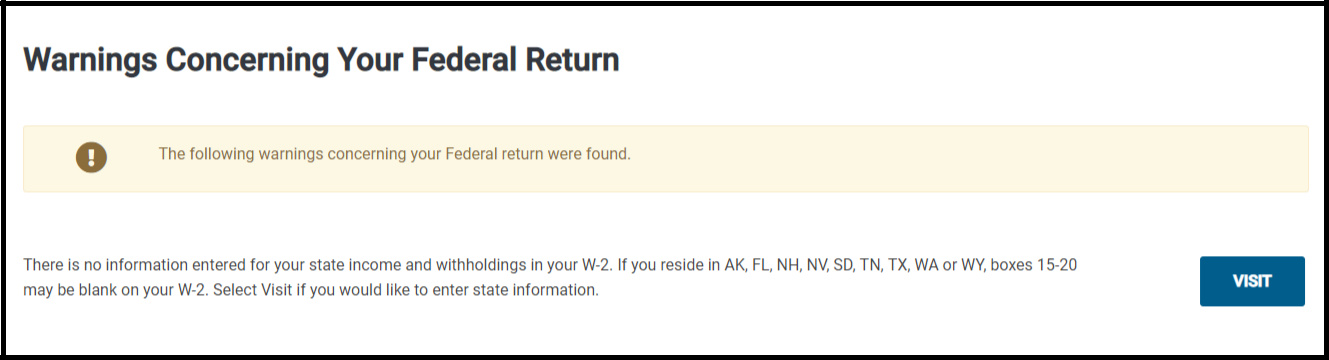

At this point, another set of diagnostics will be run on the return, conveying important information that was found regarding this return. Review the warnings. To finalize the tax return select Continue. To further review the return, select Back.

Errors (shown above) are issues with the return that must be fixed before you can proceed to the E-File page. This is to prevent your return from getting a rejection from the IRS or getting stopped by our validation process.

Warnings (shown below) are concerns with the return that should be reviewed before proceeding to the E-File page to verify the accuracy of the return.

If any notes are present in the return, the program will display a reminder about them. If the return needs further review based on these notes, select the Back button. If no further review is needed, select Continue button.

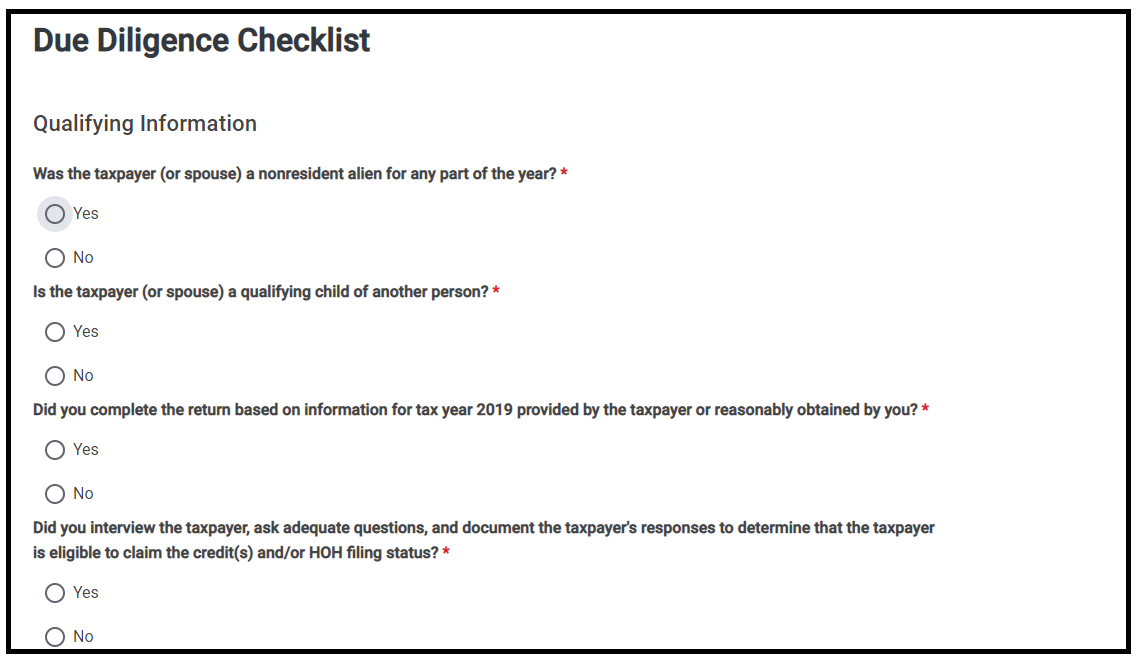

EIC Checklist

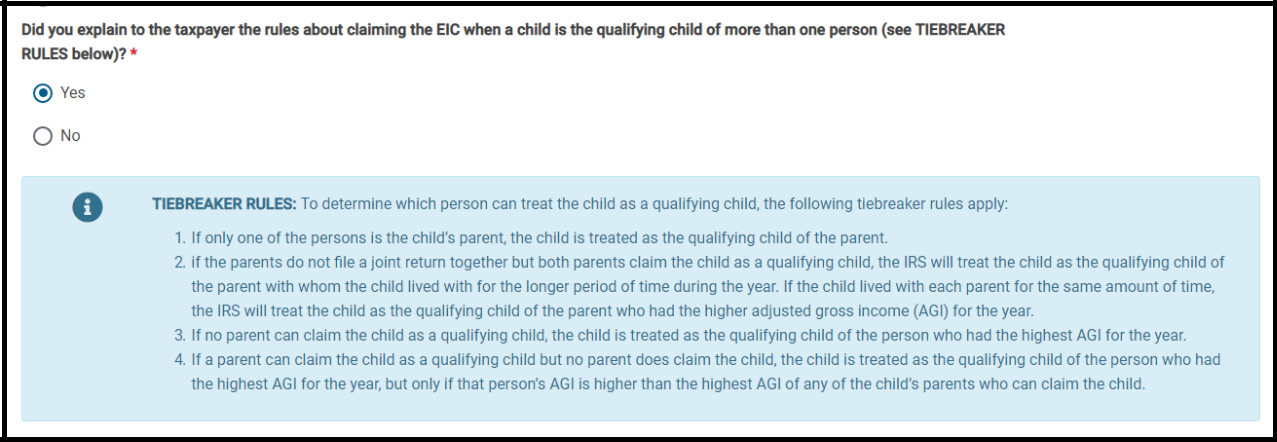

Due to increased IRS monitoring of Due Diligence, the tax program has added the EIC Checklist as part of the E-File process. Be sure to ask each client every question carefully and answer each question accordingly. Document the answers to all questions.

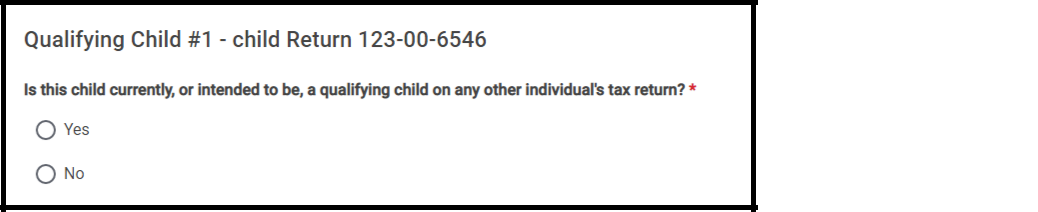

Answer the question concerning whether the child could be considered a qualifying child for another individual.

If the preparer answers Yes to the question, the tax program will display additional questions to deter-mine whether the child is this taxpayer’s qualifying child for EIC:

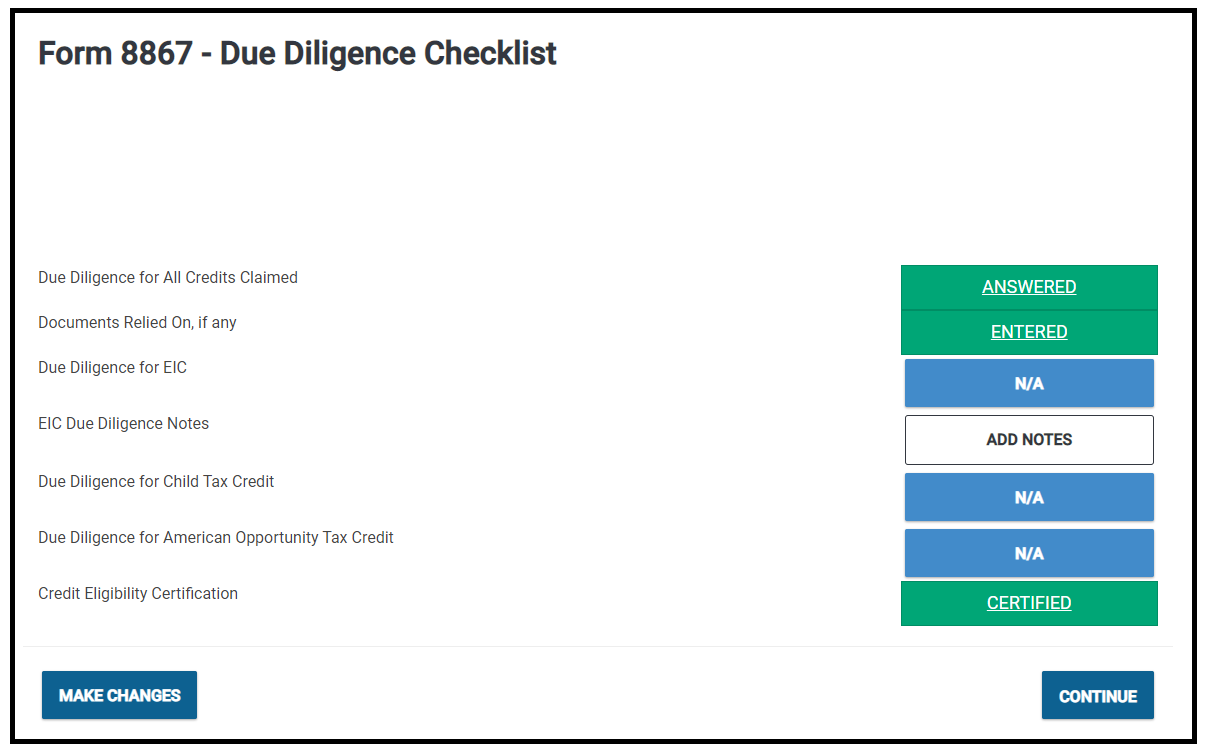

This page will show if the Due Diligence questions have been answered and if the taxpayer qualifies for EIC. If sections have not been answered, or have been answered in a way where the taxpayer does not qualify, the options will show in red.

Complete the checklist, then select “Continue”.

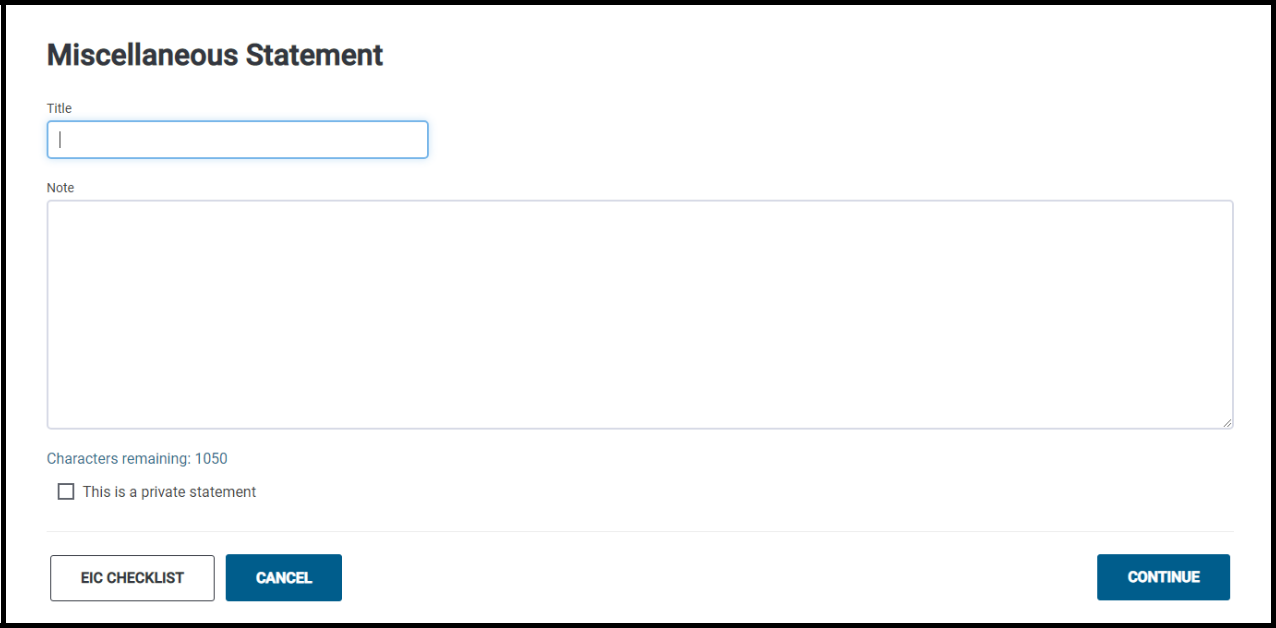

EIC Miscellaneous Statement

To document notes taken in the interview, type them in the statement box. The statement can be marked private by placing a check in the box “This is a private statement.”

Click Continue to proceed.

IRS E-File Process

When the tax return is ready to be electronically filed, the program will load the E-File menu. The taxpayer’s tax return will only be electronically filed after each step in the E-File process is complete based on the type of return being processed.

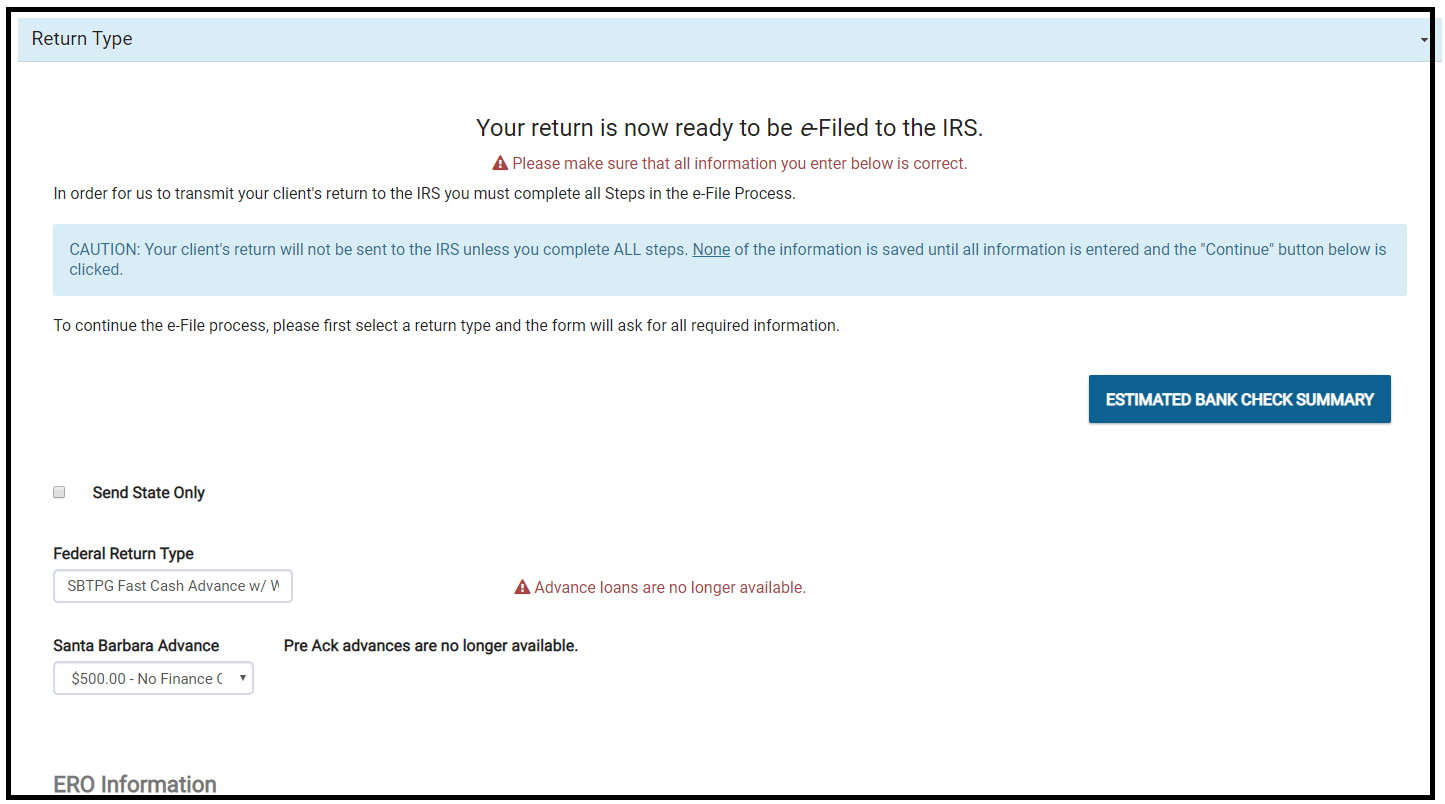

Step 1 - Return Type

Select an electronic return type from the drop-down menu. See below for a list of return type definitions.

For returns containing a federal refund:

Electronic Mailed Check – A check mailed directly to the taxpayer’s street address that is included on the tax return. Tax preparation fees will not be collected for this type of return. You must collect your fees up front from the taxpayer.

Direct Deposit – The taxpayer’s refund will be direct deposited by the IRS into their personal checking or savings account. Tax preparation fees will not be collected for this type of return. You must collect your fees up front from the taxpayer.

Electronic Refund Check (ERC) – When the taxpayer’s refund is funded and deposited to your Tax Related Products Bank, the bank will collect your tax preparation fees, processing fees and bank fees. You will print a check in your office for the remainder of the taxpayer’s refund.

Electronic Refund Deposit (ERD) - When the taxpayer’s refund is funded and deposited to your Tax Related Products Bank, the bank will collect your tax preparation fees, processing fees and bank fees. The remainder of the taxpayer’s refund will be direct deposited into their personal checking or savings account.

Prepaid Debit Card - When the taxpayer’s refund is funded and deposited to your Tax Related Products Bank, the bank will collect your tax preparation fees, processing fees and bank fees. The remainder of the taxpayer’s refund will be deposited onto a prepaid debit card.

Paper Return - If the client wishes to mail their tax return, select this option. The return should be mailed to the IRS processing center assigned to the client’s state of residence. Be sure to complete Form 8948, E-File opt-out form.

For returns containing a federal amount due:

Electronic Balance Due – If there is a balance due on the federal return, select this option to generate Form 1040-V, Payment Voucher. The return will be filed electronically, and voucher should be mailed with the accompanying payment to the address indicated on the top half of the form.

Electronic Direct Debit – If there is a balance due on the federal return, select this option to have the amount automatically debited out of a checking or savings account. You will be prompted to enter the name of the bank, the type of account (checking or savings), the bank routing transmit number and the bank account number. You will also be prompted to enter the amount of the payment, the requested payment date and the client’s day-time phone number.

NOTE: If the requested payment date is after April 15th, or the due date of the return, you must enter the current date.

Paper Return – If the client wishes to mail their tax return, select this option. The return, payment and payment voucher should be mailed to the IRS processing center assigned to the client’s state of residence.

ERO Information - If the office has multiple EROs set up in the configuration section, select the correct ERO for the electronic filing of this tax return. Use the drop-down box to view a list of valid EROs.

If the return is being sent as “State Only” place a check in the box next to “Check here to file, the return State Only. (See Filing a State Only Return on page 101.

After verifying that the Return Type and ERO information are correct, select the “Next” button to continue with the E-File process.

Step 2 - Tax Preparation and E-File Information

Client Information - Enter a valid email address for the taxpayer.

Tax Preparation Charges – After selecting the Federal Return type, the program will calculate the Tax Preparation Charges. The Calculated Prep Fee, Preparer Fee and the Electronic Filing Fee will be displayed. To charge an amount other than the calculated amount, enter the fee in the appropriate box.

Form 8879 Information – For electronically filed tax returns, the Taxpayer’s Pin, Spouse’s Pin and ERO’s Pin will be automatically pre-filled in the spaces provided. These pin numbers serve as the signatures on an electronically filed tax return.

After verifying all the E-File information is correct, select the “Next” button to continue with the E-File process.

Step 3 – State Electronic Filing Menu

Choose how the taxpayer would like to receive their state refund or pay their state balance due.

Electronic Mailed Check – A check mailed directly to the taxpayer’s street address that is included on the tax return. Tax preparation fees will not be collected for this type of return. The preparer should collect their fees up front from the taxpayer.

Direct Deposit – The taxpayer’s refund will be direct deposited by the state into their personal checking or savings account. Tax preparation fees will not be collected for this type of return. The preparer should collect their fees up front from the taxpayer.

Send State Through Bank- If the taxpayer has elected to have their federal refund processed as a bank product then they can elect to have their state refund processed as a bank product as well. Depending on the bank will depend on how the state refund is distributed. Please check with your bank for verification.

After verifying all the State E-File information is correct, select the “Next” button to continue with the E-File process. Once you have completed Third Party Designee information and the following categories, the last step is to continue to the E-file Summary. Do this by selecting the “Save” button.

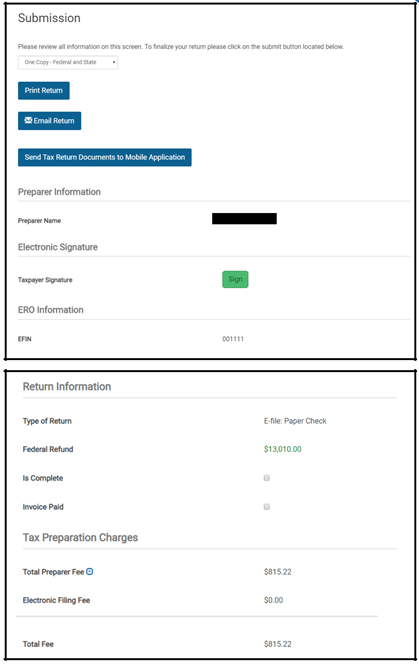

Step 4 – Submission

The last step of the IRS E-File process is to submit the return from the E-File Summary page. This page presents the option to print the tax return and Form 8879 (federal and state). All previously entered E-File information will also be displayed on this page. Be sure the return is ready to be electronically filed, and that all the information has been verified. The return must be marked Is Complete (via the checkbox under the section titled Return Information). Select Save And Transmit Return to IRS to E-File the return.

(See the following page for images of Submission Page.)

Review Status

Sometimes new tax preparers need assistance with the completion of tax returns. The Return Review tool allows the tax preparer to mark the return for further review. Preparer Security templates can be created and assigned to the tax preparer requiring them to mark the return Ready for Review, then to Save and Exit Return instead of transmitting the return. Once a return has been marked for review, it cannot be E-Filed until it has been approved. For more information about Return Review, see page 108.

NOTE: Most offices receive acknowledgements from the IRS within 4 hours of transmitting the return.

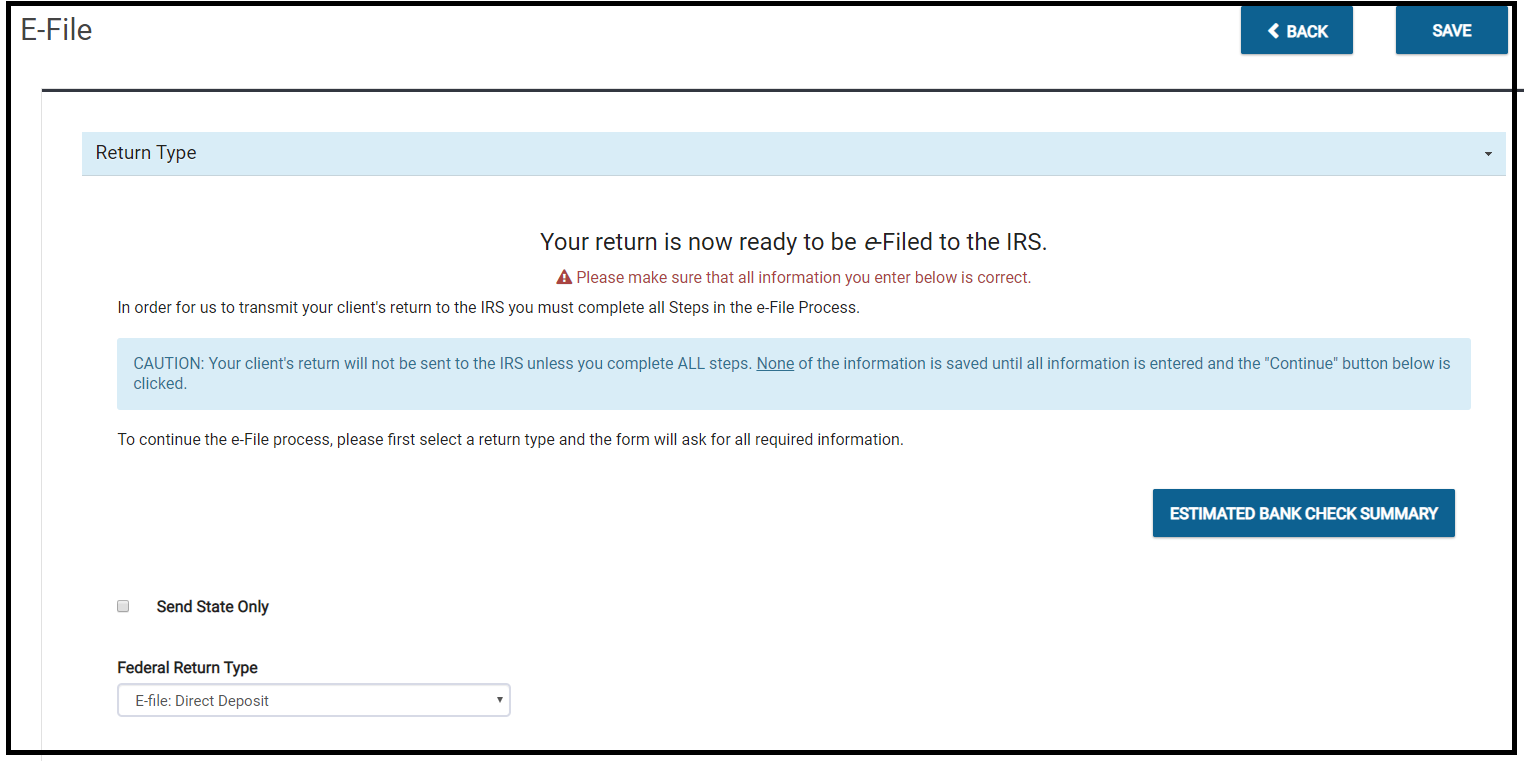

E-filing a State Only Return

Under most circumstances, both the federal and state returns are electronically filed together. There may be occasions when it is necessary to electronically file only the state portion of a tax return. To e-file a state-only return, place a checkmark in the Send State Only box on the “Return Type” section of the E-File page.

NOTE: Federal Return Type must be selected even though you are filing State Only.

Continue with the E-File process as described on the previous pages. Prior to submitting the return for electronic filing, review the E-File Summary screen. The Type of Return should read:

State Only - Federal Return is NOT being submitted to the IRS. The state return information should list the state(s) and the type of return for each. Select Save and Transmit Return to IRS to transmit the state only return. Most offices receive acknowledgements from the state(s) within 48 hours of transmitting the return.