Health Insurance

Under the TCJA, the penalty for not having health coverage has dropped to $0. If the taxpayer purchased coverage through the Marketplace, they may be eligible for the premium tax credit or need to reconcile any advance payments made on their behalf. 1095-A amounts will still need to be reported to accurately determine these amounts.

If a taxpayer did not have health coverage, you will just put select that they did not. You will not need to fill out Form 8965, as it has been eliminated.

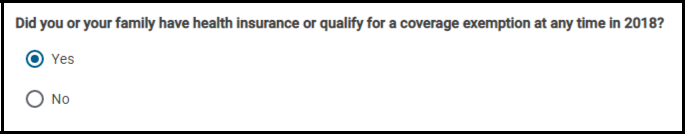

Health Insurance Questionnaire

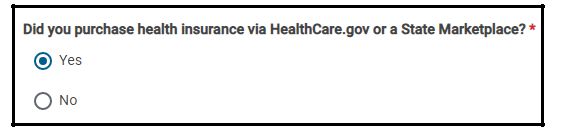

Answering “Yes” to the above-pictured questionnaire will prompt the preparer to answer another question as to whether health insurance was purchased via HealthCare.gov or a State Marketplace.

If the insurance was purchased through HealthCare.gov or a State Marketplace, the taxpayer should provide the preparer with form 1095-A to determine the months the insurance covered and the monthly premium amounts.

Next, a prompt appears to verify household members. Additional household members that are not already entered under Spouse/Dependent section can be added.

Months Insured - If the person listed under “Name” was insured for 12 months, answer “Yes” and press Continue. Otherwise, select the number of months they were insured before pressing Continue. On the following screen, place a checkmark next to the months the individual was covered by insurance based on the previous question.

1095-A

The healthcare exchange will send information about individuals enrolled in “qualified health plans” (QHPs) sold through the exchange to the IRS. “Each taxpayer or responsible adult who enrolled, or whose family member enrolled” in an exchange QHP will get a summary of information going to the IRS on Form 1095-A

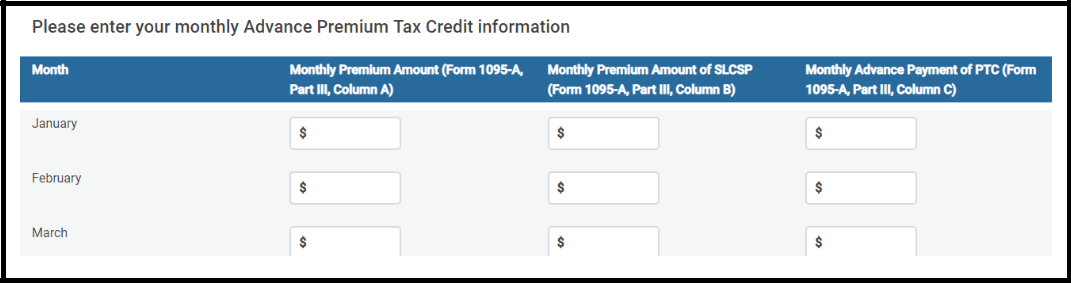

Advanced Premium Tax Credit

If the taxpayer, spouse, or dependent received an Advanced Premium Tax Credit, input the amounts listed on Form 1095-A.

Dependents’ Modified AGI

A dependent’s MAGI is included in household income for calculating Premium Tax Credit allowances.

This information populates Form 8962, Premium Tax Credit.

Under TCJA you will not need to report any heath care exemptions. The form has been eliminated.

State Section

If a State of Residency was selected within the Personal Information screen, a resident state return will be created automatically.

If the situation does not require a state return, click Continue or use any of the navigation options on the left navigation bar.

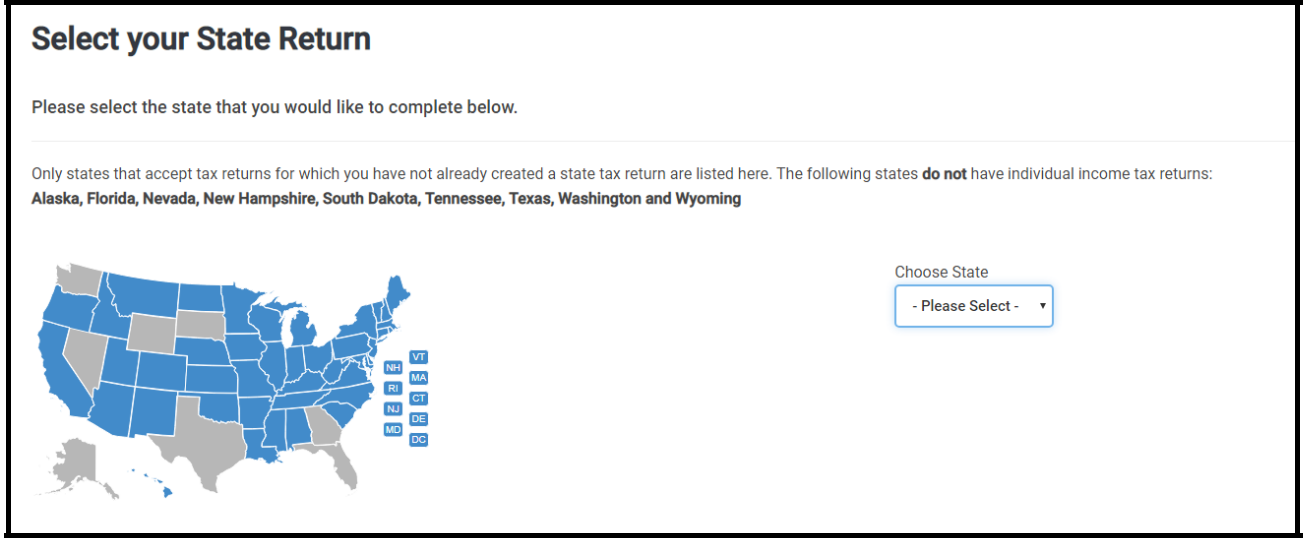

The following states do not have state income tax returns that can be filed through the program: Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington and Wyoming

The Add Another State Return(s) button allows the preparer to create any necessary state returns. Choose a state from the drop-down box located on the State Return page or choose from the map and select Continue.

The preparer will be prompted to select the taxpayer’s state residency type. Most states have a separate resident, part year resident and non-resident tax return. Select the Continue.

This will open the State Return screen which lists the various sections of the state return. Select the Begin button to enter other state data applicable to the taxpayer. The federal and state information entered on the federal return will automatically pull into the state. When all applicable state data items are entered, select the Continue button.

To delete a state return, select State Return from the left side of the screen. Selecting the delete icon next to the state will remove it. (See image on the following page.)

The program will ask the preparer to confirm this action. Select the Cancel to opt not to delete the selected state return. Select the Delete button to permanently delete the selected state return. After the delete button is selected, the preparer must re-enter any state information if they determine the state return is necessary later.

Once the federal and state(s) return are completed, click Continue to the Summary/Print page.