Payment and Estimates

The Payments & Estimates portion of the Federal Section is used to enter such items as estimated payments, to apply overpayments to next year’s return, and to print payment vouchers. Select the Begin button next to any payment or estimate item to enter in data applicable to the taxpayer.

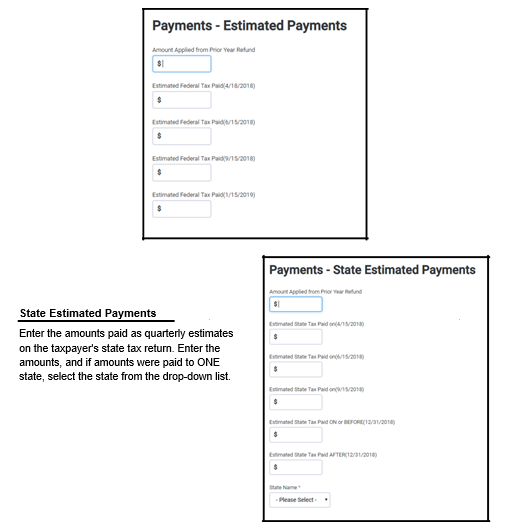

Federal Estimated Payments for 20XX

If the taxpayer made quarterly estimated payments for the tax year, enter the dollar amount in the space provided next to the applicable date. Also enter in the estimated payments menu any amount that the taxpayer applied to this year’s tax liability from their prior year refund.

Other Federal Withholding

If the taxpayer has a Form 1099 that shows Federal Tax Withheld, include the withholdings in the Other Federal Withholding Menu and indicate that the withholdings are from a 1099. Also include any withholdings that MAY NOT be included on a Form 1099 in this menu option.

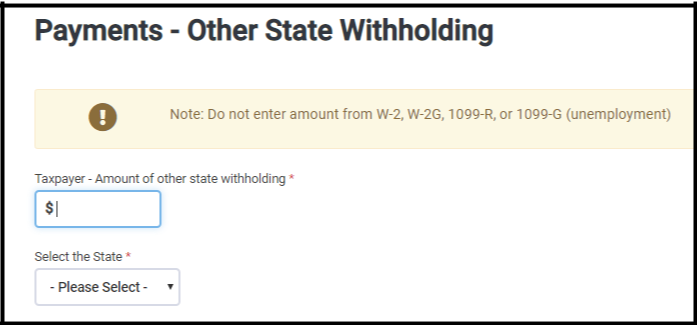

Other State Withholding

Enter any additional state withholdings that the taxpayer may have paid, and that have not yet been accounted for anywhere else within the program. If amounts were paid to ONE state, select the state from the drop-down list.

Underpayment of Estimated Tax

If the balance due on the taxpayer’s Federal return is more than $1000, they may be subject to an estimated tax penalty. If there is a penalty due, the IRS will calculate the penalty and send a notice by mail.

To use the tax program to calculate the penalty, enter the required information in the Underpayment of Estimated Tax menu.

NOTE: The IRS’s calculations can supersede this.

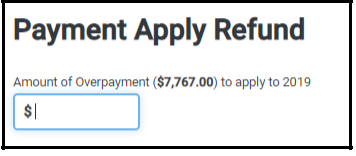

Apply Overpayment to Next Year’s Taxes

Enter the amount of the taxpayer's overpayment (refund) from this year’s tax return to be credited to next year's tax return. The program will not accept an amount larger than the refund for this year.

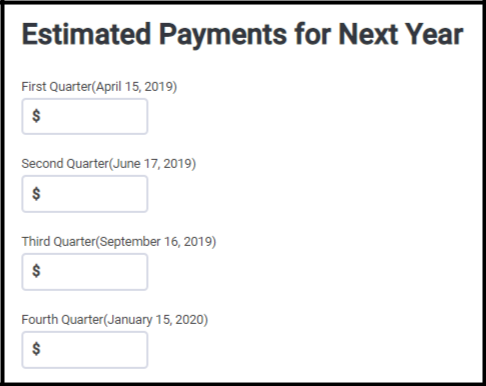

Vouchers for Next Year’s Estimated Taxes

Use this menu to generate estimate vouchers for the taxpayer's quarterly estimated tax payments for next year. The vouchers will print from the summary/print section with the tax return.

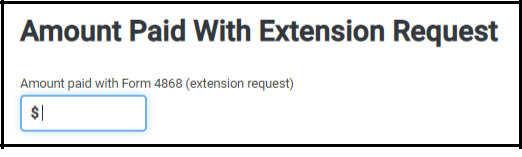

Amount Paid with Extension

If Form 4868 was filed to get an automatic extension of time to file the taxpayer’s tax return, enter any amount that was paid with that form, by electronic funds withdrawal, or credit or debit card. If a credit card was used do not include the convenience fee the taxpayer was charged. Also include any amounts paid with Form 2350.

Miscellaneous Forms

The Miscellaneous Forms portion of the Federal Section is used to enter the following:

Injured Spouse Form - Form 8379

Injured spouse relief applies when a couple files jointly and has their tax refund reduced or eliminated because of an unpaid tax or other debt that only one of them owes. For example, one spouse may owe taxes from a year before the couple married. The other spouse has a right to his or her share of the refund, based on an allocation of income, deductions, payments and other tax return items between the two spouses.

If the IRS has applied the taxpayer's refund against the spouse's tax liability, or the taxpayer is concerned that the IRS may do so, complete Form 8379 – Injured Spouse Claim and Allocation. The form requests identifying information for the taxpayer and spouse, and information needed to determine how much of the tax — and refund — is attributable to each spouse. The IRS makes the final determination that divides the refund between the taxpayer and his or her spouse.

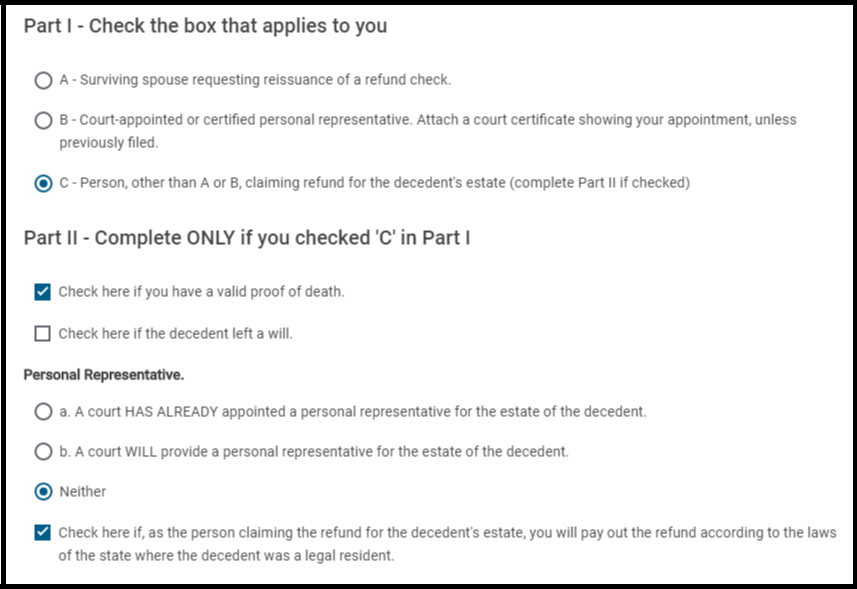

Claim a Refund Due to a Deceased Taxpayer - Form 1310

If the taxpayer is claiming a refund on behalf of a deceased taxpayer, Form 1310 must be filed.

This form can be electronically filed with the tax return. To avoid a rejected return, complete the Form 1310 menu as shown below:

NOTE: If the facts of the situation do not allow the input to match the example above, the return will need to be mailed.

Application for Extension - Form 4868

To file an extension for the taxpayer, complete the Required Extension Information section from the Form 4868 – Extension Menu. When the extension is ready to transmit, select the E-File option from the left navigation options. The program will present the option to file the return (Form 1040 and supporting schedules), or to file the extension (Form 4868). Complete the extension E-File process. An acknowledgement regarding the taxpayer’s extension should arrive within 24- 48 hours of filing.

Married Filing Separate Allocation

Community property laws apply to married individuals living in community property states who file separate returns. Each spouse must report half of combined community income and deductions in addition to his or her separate income and deductions. For example, the taxpayer would report half of his or her own wages on a W-2 and also reports half of the spouse’s wages on a W-2.

If the preparer is filing the return as married filing separately and the taxpayer lives in a Community Property State (Arizona, California, Idaho, Louisiana, Nevada, New Mexico, Texas, Washington, Wisconsin) the MFS Allocation Record should be completed with the return. A registered domestic partner in California does not include one-half of a partner's income on his or her separate tax return.

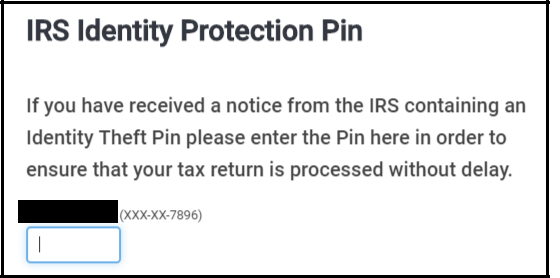

IRS Identification Pin

Beginning in January 2011, the IRS started sending a notice (CP01A) to taxpayers who had previously contacted them and have since been validated by the IRS as being a victim of identity theft. The new notice will provide the taxpayer with a 6-digit identity protection PIN (IP PIN), valid for the filing of their current year federal tax return only. Including the IP PIN on the taxpayer's current year federal tax return will avoid delays in processing of the return by distinguishing the taxpayer from a possible identity thief. In the event the taxpayer loses or misplaces the CP01A notice, they will need to retrieve their IP PIN online at the IRS Website. Otherwise, they may call 1-800-908-4490 to have their IP PIN snail mailed to them. Mailing can take up to 21 days.

Installment Agreement (Form 9465)

An installment agreement allows the taxpayer to break down their tax debt into manageable payments. Usually an installment agreement requires equal monthly payments based on the amount of taxes owed, the amount of money the IRS can collect at one time, and the amount of time they are allowed to collect the funds from the taxpayer. Installment agreements are not an ideal way of paying a tax debt, since the taxpayer will still accrue late payment penalties and interest over the life of the agreement.

Form 9465 can be used to request an installment plan but should not be used if the taxpayer plans to pay their tax debt within 120 days, or if they want to use the IRS Online Payment Agreement Application to apply for an installment agreement. Installment agreements are not guaranteed. The IRS will notify an individual within 30 days of receiving the agreement if it has been approved or denied.

Agreements for less than $10,000 will generally be accepted if:

- During the last 5 years, the taxpayer (and spouse if filing jointly) has timely filed all income tax returns, paid any amount due, and have not previously used an installment agreement.

- The IRS determines that the taxpayer cannot pay the taxes owed when they are due in full, and the taxpayer gives the IRS any information needed to make the determination.

- The taxpayer agrees to pay the full amount within 3 years and agree to abide by tax laws while the agreement is in effect.