Interest and Dividend Income

Up next on the Income menu is Interest and Dividend Income. Clicking BEGIN will open a new menu with three items listed:

- Interest or Dividend Income

- Did you have interest in a foreign bank account?

- Exclusion of Interest from Series EE & I US Savings Bonds

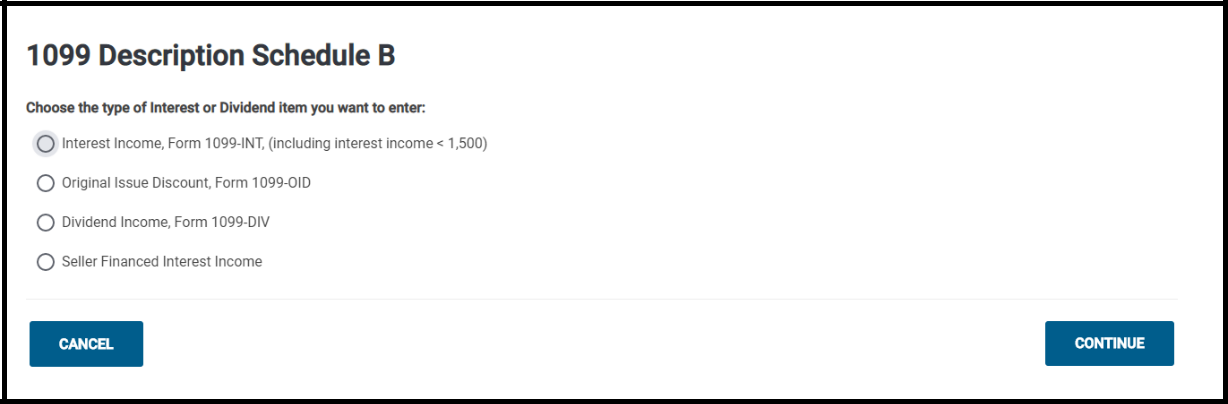

Selecting Interest or Dividend Income will prompt the screen above, with four options covering various types of income. Multiple entries can be made, like the W-2 menu.

- Interest Income: Most 1099-INT income is entered here, regardless of amount. This field is also present for entering the Original Issue Discount (OID) adjustment.

- Tax Exempt Interest Income: Where tax exempt interest income and/or tax-exempt dividend income is entered.

- Dividend Income: The remaining 1099-DIV income not covered above is entered here.

- Seller Financed Interest Income: Payer information, including SSN and address, is required along with the amount of interest income.

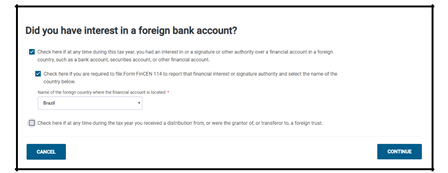

If a taxpayer has a financial stake or signature authority over an account located in a foreign country, the tax preparer must complete the second Interest and Dividend menu: Interest in a Foreign Bank Account. This menu also addresses foreign trusts.

Initially this menu will consist of just two options; the first option is regarding financial accounts; the second option is for foreign trusts. The first box will expand, as seen in the image on the following page, based on the preparer’s responses.

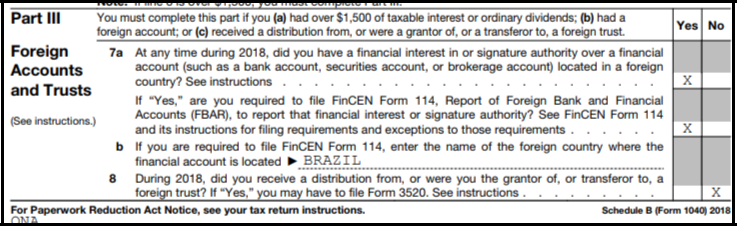

Numerical information is not entered on this menu. The only options are those seen in the above image. The tax preparer’s responses will populate on Part III of Schedule B. The income itself is entered in the previous section (Interest or Dividend Income).

If the Foreign Accounts and Trusts menu is not completed in the program, but the taxpayer received over $1,500 in taxable interest/dividends, the answers above will default to no.

Exclusion of Interest from Savings Bonds

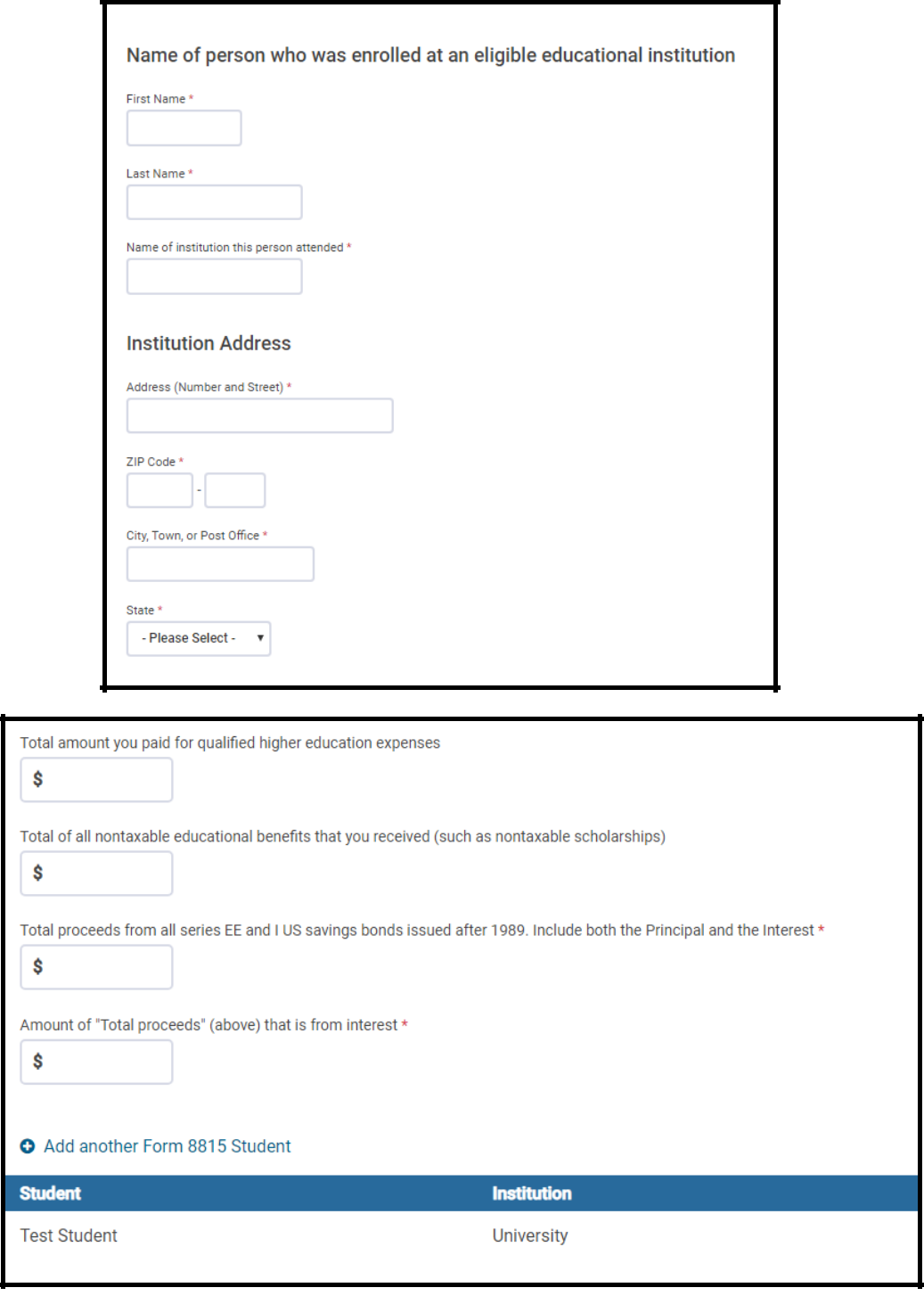

The final submenu under Interest and Dividend Income covers Exclusion of Interest from Series EE & US Savings Bonds. Interest earned from eligible Series EE and I bonds may be excludable if the taxpayer paid tuition and/or other education expenses during the tax year. To qualify, the bonds must have been issued after 1989 and after the taxpayer’s 24th birthday. The education expenses can be incurred by the taxpayer, their spouse, and/or their dependent.

If a client has cashed qualifying bonds, the tax preparer must complete the following two menus to claim the exclusion (Form 8815). The first menu covers the student and education institution; the second menu covers the expenses and earned interest. Multiple students can be entered as part of the first menu. All expenses and income can be lumped together and entered on the second menu.