Federal Section

Over the next few sections the following topics will be covered: Income, Deductions, Other Taxes, Payments & Estimates and Miscellaneous Forms.

Income

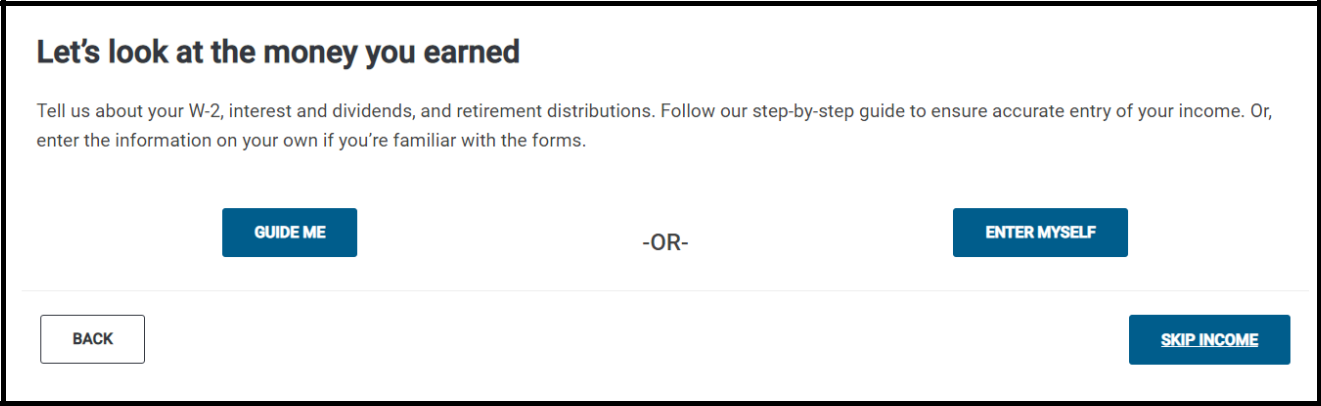

The Income portion of the Federal Section is the first opportunity a preparer can use Web1040 Pro’s Guide Me feature. Guide Me is an aid that asks the preparer numerous questions about the taxpayer. This tool enables the preparer to find the correct location to enter any income received by the taxpayer.

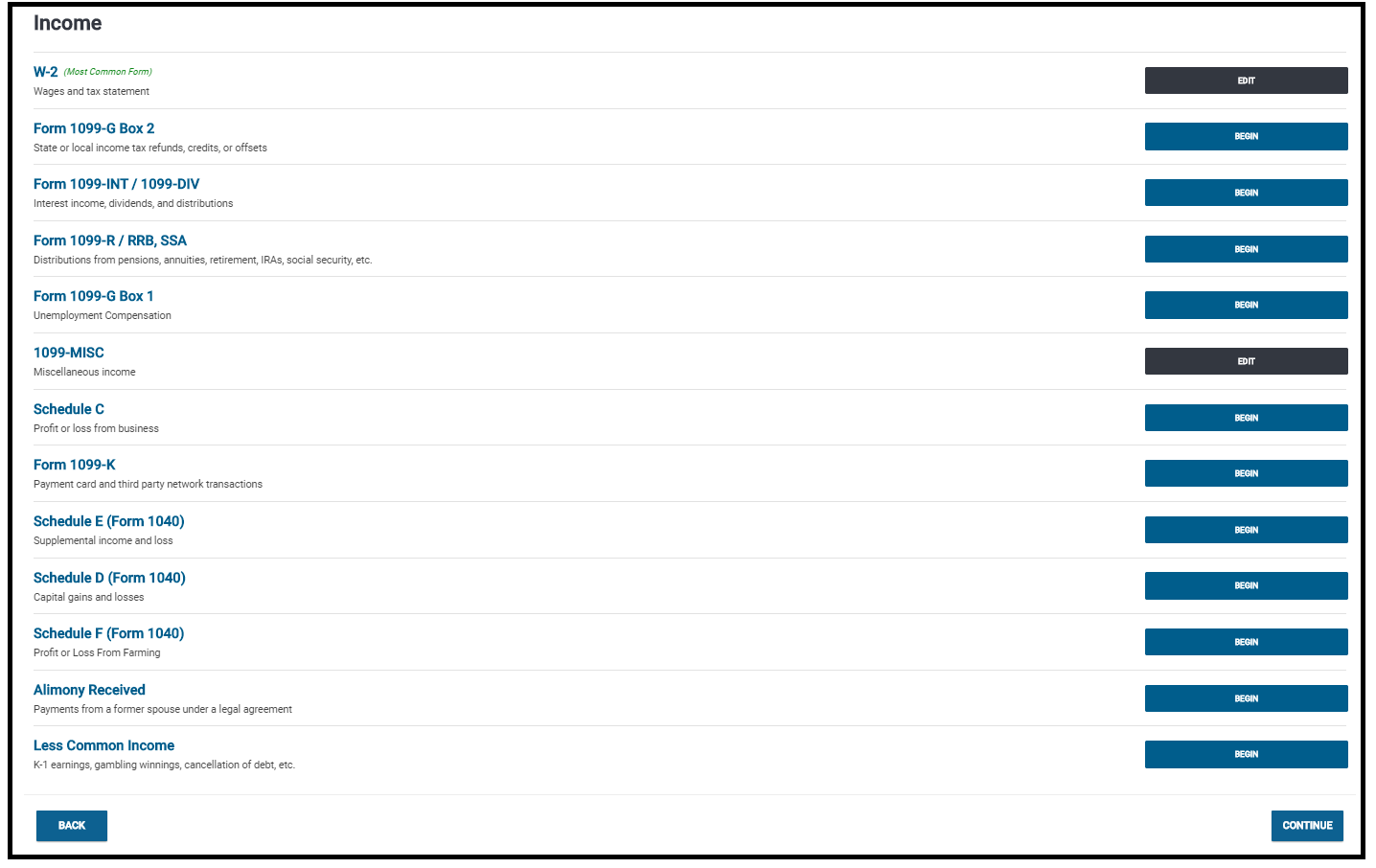

If you prefer to enter data without assistance, select Enter Myself on the screen above (previous page). This will direct the preparer to the Income main menu. Click Begin to access any of the Income submenus. Each form of income will be covered in the following units.

NOTE: Once information has been entered in a submenu, the button will change from BEGIN to EDIT.

Wages and Salaries

The first income section is for W-2 input. Use the following steps to enter taxpayer data:

- Click BEGIN on Wages and Salaries (Form W-2)

- Enter the EIN for taxpayer’s employer. If the EIN was previously used at the preparer’s office, employer name and address will pre-populate

- After EIN entry, preparer is taken to menu that resembles a W-2. Enter all information listed on taxpayer’s form.

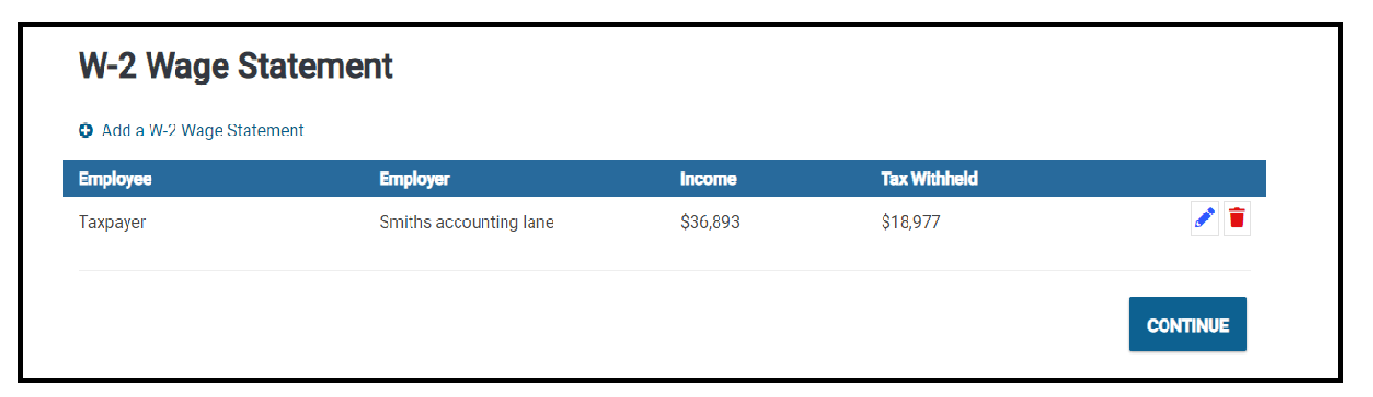

- Once finished, you have the option to SAVE & ENTER ANOTHER. If you click Continue, the data will save and the screen (on the next page) appears. From there you can also click Add to enter additional W-2s for taxpayer or spouse. Previous entries can be edited or deleted.

NOTE: You can add up to 4 states on each W-2.

State and Local Refunds

The second section on the Income main menu is for taxable state and local refunds. If a taxpayer received a refund from their state(s) taxing authority during the tax year, retroactive to the prior year tax return, and they also itemized deductions on their federal return, their state refund is generally taxable since the full amount was claimed as a deduction.

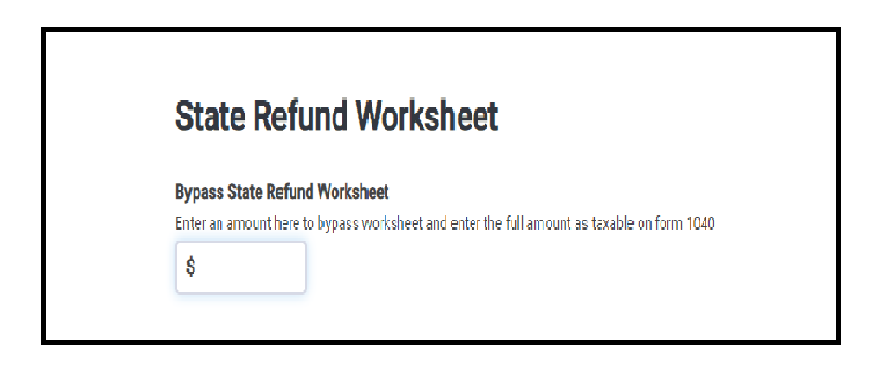

Web1040 Pro provides preparers with two options for entering state refunds. A worksheet is available that calculates the taxable portion of the state refund, or the tax preparer can bypass the worksheet and enter the taxable amount based on their own calculation.

If the taxpayer chooses to bypass the worksheet, the tax preparer only makes an entry under Bypass State Refund Worksheet. The remaining instructions are for using the worksheet.

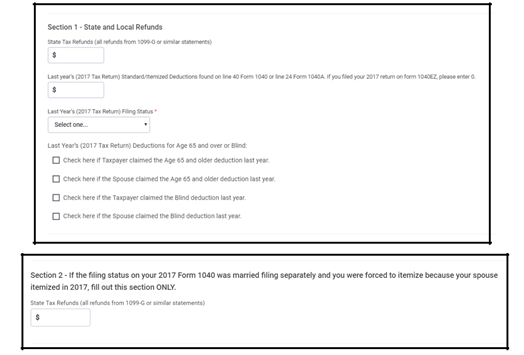

Section 1 of the worksheet is for all taxpayers, minus those who used the status married filing separately on the previous year tax return. Those individuals will enter their information in Section 2.

- Under Section 1, State Tax Refunds, enter information from current year 1099-Gs (or similar statements).

- Answer the next two questions using the previous year tax return.

- Complete the checkboxes for taxpayer/spouse deductions taken on previous year return.

- If the filing status on the previous year return was Married Filing Separately, complete Section 2 only.

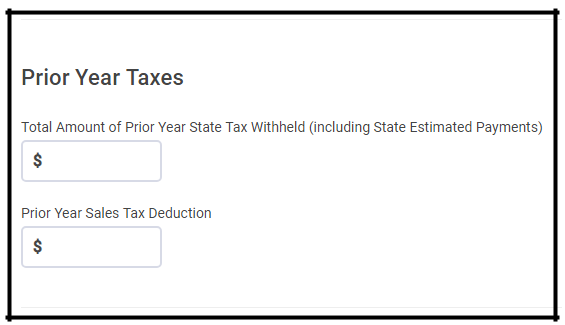

Prior Year Taxes

The amount of your taxable State and Local refund can be minimized by calculating the difference between the total amount of prior year state tax and prior year state tax deduction. These amounts may be entered under the Prior Year Taxes section at the bottom of the State and Local Refund menu.